Net Working Capital What Is It, Formula, How to Calculate

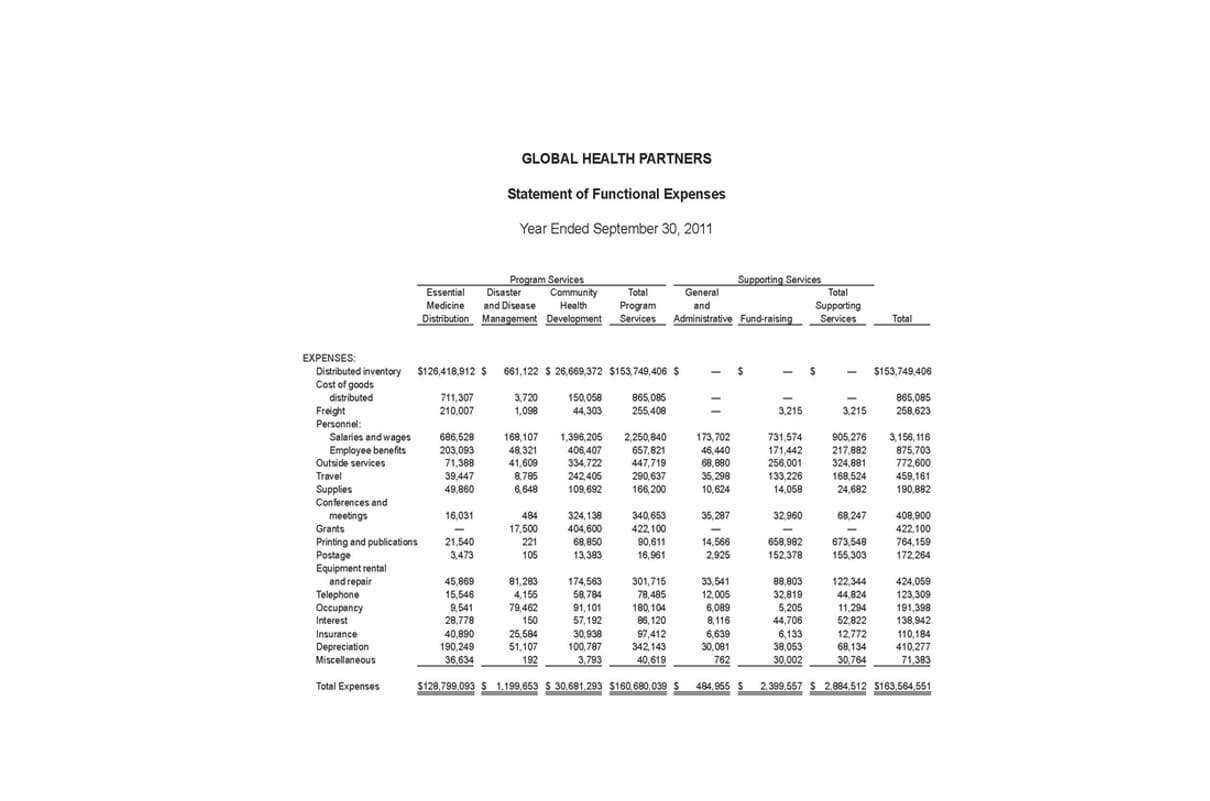

Software companies generally tend to have a positive change in working capital cash flow because they do not have to maintain an inventory before selling the product. It means that it can generate revenue without increasing current liabilities. The net working capital (NWC) is the difference between the total operating current assets and operating current liabilities. Investors use NWC to know whether a company is liquid enough to pay off its short-term liabilities. If you change in net working capital look at current assets and current liabilities, you will find them on the balance sheet. The net working capital calculation is an essential financial metric used to measure the deviation or divergence between an entity’s current assets and current liabilities.

Add Up Current Liabilities

- Working capital can only be expensed immediately as one-time costs to match the revenue they help generate in the period.

- Imagine if Exxon borrowed an additional $20 billion in long-term debt, boosting the current amount of $40.6 billion to $60.6 billion.

- Positive change indicates improved liquidity, while negative change may signal financial difficulties.

- We have been given both current assets and current liabilities in the above example.

- This revenue is considered a liability until the products are shipped to the client.

Unlike working capital, it uses different accounts in its calculation and reports the relationship as a percentage rather than a dollar amount. A company’s balance sheet contains all working capital components, though it may not need all the elements discussed below. For example, a service company that doesn’t carry inventory will simply not factor inventory into its working capital calculation.

What is Negative Net Working Capital?

- It’s a commonly used measurement to gauge the short-term financial health and efficiency of an organization.

- Still, it’s important to look at the types of assets and liabilities and the company’s industry and business stage to get a more complete picture of its finances.

- The amount would be added to current assets without any debt added to current liabilities; since current liabilities are short-term, one year or less, and the $40.6 billion in debt is long-term.

- The NWC metric is often calculated to determine the effect that a company’s operations had on its free cash flow (FCF).

Conversely, negative working capital occurs if a company’s operating liabilities outpace the growth in operating assets. This situation is often temporary and arises when a business makes significant investments, such as purchasing additional stock, new products, or equipment. To calculate working capital, subtract a company’s current liabilities from its current assets. Both figures can be found in public companies’ publicly disclosed financial statements, though this information may not be readily available for private companies.

Streamline your inventory management

You might ask, “how does a company change its net working capital over time? ” There are three main ways the liquidity of the company can be improved year over year. Second, it can reduce the amount of carrying inventory by sending back unmarketable goods to suppliers. Third, the company can negotiate with vendors and suppliers for longer accounts payable payment terms. Each one of these steps will help improve the short-term liquidity of the company and positively impact the analysis of net working capital. Since Paula’s current assets exceed her current liabilities her WC is positive.

How to Calculate Change in Net Working Capital (NWC)

We’ll now move on to a modeling exercise, which you can access by filling out the form below. The change in net revenue is the difference between the ending and beginning balance. In the final part of our exercise, the incremental net working capital (NWC) will be calculated and expressed as a percentage. The net working capital (NWC) of gross vs net the company is increasing by $2 million each period.

A company with a negative net WC that has continual improvement year over year could be viewed as a more stable business than one with a positive net WC and a downward trend year over year. Since the company is holding off on https://www.bookstime.com/ issuing payments, the increase in payables and accrued expenses tends to be perceived positively. The textbook definition of working capital is defined as current assets minus current liabilities. Now that we understand the basics and the formula of the concept, let us understand how to calculate the changes in net working capital cash flow through the step-by-step explanation below. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Recent Comments