Individual Taxpayer Identification Number Internal Revenue Service

When you are filing an ITIN application alongside a tax return, the responsible officer at your school cannot certify the documents you are providing. International Student and Scholar Services (ISSS) staff are not tax professionals or certified public accountants. For professional advice, please consult with a licensed tax professional with experience in nonresident taxes or the Internal Revenue Service (IRS). You will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete. You should expect to hear back from the IRS about your approval status after no more than seven weeks — look for a letter in the mail with your ITIN when your application is approved. You will need to complete Form SS-5, Application for a Social Security Card PDF.

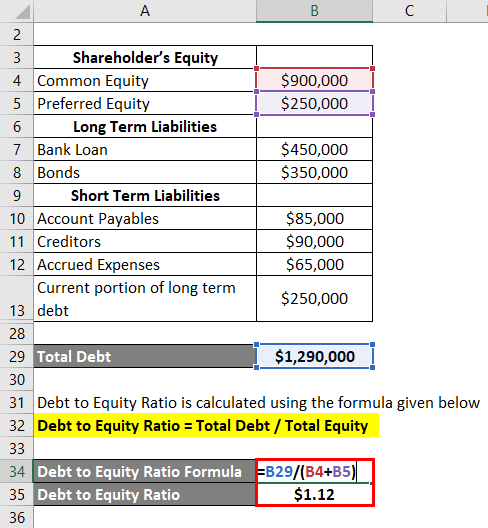

ITIN Approval Letter

Those affected by Hurricane Beryl in Texas and Hurricane Debby in some states in the Southeastern United david knopf States have more time to file federal tax returns and make certain tax payments. The additional time allowed by the IRS includes tax returns that were extended by the original April 15, 2024, deadline as well as certain payments that are normally due after the storms impacted these people. Most people applying for an ITIN can only do so if they are also filing their U.S. federal income tax return. However, if you meet one of the IRS Exceptions, then you can apply for the ITIN at any time and you do not have to include a U.S. tax return with your ITIN application. While it is possible to apply for an ITIN and file your federal income tax return at the same time, it is easier to have it beforehand. Please choose a method that will allow you to remain in possession of your passport and visa stamp.

TURBOTAX ONLINE GUARANTEES

Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Live Assisted. And if you want to file your own taxes, you can still feel confident you’ll do them right with TurboTax as we guide you step by step. No matter which way you file, we guarantee 100% accuracy and your maximum refund. If you do not want to apply for a PTIN online, use Form W-12, IRS Paid Preparer Tax Identification Number Application. Acceptance Agents are entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs.

- After you get your relevant documents certified, you can send your application to the IRS, accompanied by a signed W-7 form (also known as ‘Application for IRS Individual Tax Identification Number’).

- Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual.

- You will need to hire an accountant who specializes in U.S. taxes for foreigners.

- Just click on the state where you formed an LLC and call a few accountants.

- An ITIN is not required if you did not have any taxable income from U.S. sources during the tax year (January 1-December 31).

- It is issued either by the Social Security Administration (SSA) or by the IRS.

Although the word “Employer” is in the name, you don’t have to have employees in order to obtain and use this number. An EIN is issued by the IRS to businesses for tax reporting requirements. You will also use an EIN to open a business bank account after forming an LLC in the U.S. Your passport is the only document that can be used to both prove your identity as well as prove foreign status, however, some documents can only be used for one of these purposes. To see which documents can be used for which purpose, please see the IRS instructions for Form W-7 and look under the section titled “Supporting Documentation Requirements” (see #3). The IRS will use this address to send your ITIN Approval Letter as well as return any original documents (if necessary).

An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441). The Form 2441 must be attached to Form W-7 along with the U.S. federal tax return. This number is used by people who are not eligible for an SSN and have a U.S. tax filing or informational reporting requirement. The IRS sends this letter to let you know that they are returning original documents, such as your passport or proof of identity (if you sent original documents instead of certified copies).

Your school will typically have an officer who is responsible for certifying copies of your documents (such as passport, visa, i-20/DS-2019). If you just need to file Form 8843 (had no accounts payable ap definition taxable US income) then you likely will not need an ITIN either. You can also find comprehensive instructions and forms on the IRS website.

To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. Form W-7(SP), Solicitud de Número de Identificación Personal del Contribuyente del Servicio de Impuestos Internos is available for use by Spanish speakers.

How is the process different when applying for an ITIN before filing my tax return?

Instead, ITINs allow individuals to comply with United States tax laws. Simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and student loan interest). For more information see Allowable Tax Benefits in the Instructions for Form W-7 PDF. Instead, whenever the above forms ask for an SSN or ITIN, just enter “ITIN to be requested“. If you are eligible for an SSN and have already submitted an application for an SSN (and have not heard back yet), do not apply for an ITIN.

All Form W-7 applications, including renewals, must include a U.S. federal tax return unless you meet an exception to the filing requirement. This interview will help you determine if you should file an application to receive an the 5 best accounting software of 2021 individual taxpayer identification number (ITIN). An ITIN is a tax processing number, issued by the Internal Revenue Service, for certain resident and nonresident aliens, their spouses, and their dependents.

Recent Comments