However, that’s not the case with equity, which by definition means you’re trading a stake in your business for financing that you don’t need to repay. Obviously, debt is also more expensive (since you’re paying for it), and lenders need to see that you’re in a position to pay back any loans that they give you. Remember, the riskier you look, the less likely you are to get a loan—or, at least, one with favorable terms. For many small business owners, scaling a business sometimes requires a little bit of outside help financially.

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

For purposes of this section, Bonds exclude treasury securities held in treasury accounts with Jiko Securities, Inc. as explained under the “ Treasury Accounts” section. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Total Liabilities

It shows that you don’t have as much debt on your balance sheet; rather, you’ve been able to secure more financing from investors, who have confidence in your operations. Your debt-to-equity ratio is also a kind of overall picture of how your business has been raising capital—and, perhaps, whether you’ll be able to raise more. Small business lenders and credit card companies are interested in this ratio since it’ll give them a sense of whether you’ll be able to make your debt payments. Also, not all industries are created equal when it comes to debt and how it’s leveraged. There are a variety of industries that require more debt just to run the business and are known as capital-intensive industries.

Which of these is most important for your financial advisor to have?

What counts as a good debt ratio will depend on the nature of the business and its industry. Generally speaking, a debt-to-equity or debt-to-assets ratio below 1.0 would be seen as how to handle 3 critical stages of business growth relatively safe, whereas ratios of 2.0 or higher would be considered risky. Some industries, such as banking, are known for having much higher debt-to-equity ratios than others.

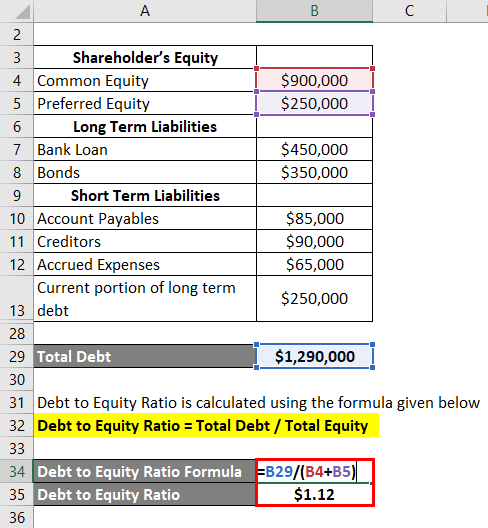

That may make paying for his current debt very difficult and can signal tough times ahead. To calculate your business’s debt-to-equity ratio, you’ll divide your total liabilities by your total equity. A lower debt-to-equity ratio is generally linked to a more financially stable business.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth. The current ratio measures the capacity of a company to pay its short-term obligations in a year or less.

It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company. As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons. Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky.

- Bonds with higher yields or offered by issuers with lower credit ratings generally carry a higher degree of risk.

- A company’s accounting policies can change the calculation of its debt-to-equity.

- Get instant access to video lessons taught by experienced investment bankers.

- Such an agreement prevents the borrower from taking on too much new debt, which could limit the original creditor’s ability to collect.

- Other industries in similar situations include manufacturing, utilities, airlines, and other transportation business models.

The money can also serve as working capital in cyclical businesses during the periods when cash flow is low. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash. They can also issue equity to raise capital and reduce their debt obligations. The current ratio reveals how a company can maximize its current assets on the balance sheet to satisfy its current debts and other financial obligations. The D/E ratio of a company can be calculated by dividing its total liabilities by its total shareholder equity.

Recent Comments